Sales and demand forecasters have a variety of techniques at their disposal to predict the future. While most analysts will examine historical sales or other kinds of data as a guide, many forecasters rely heavily on judgment. There’s no question that judgment can (and probably should!) play a significant role in arriving at your final, consensus forecast–but statistical forecasting can offer a level of automation and insight that can substantially improve your forecast accuracy, particularly when you are producing large quantities of forecasts on a rolling basis.

This article covers two common approaches for forecasting sales using statistical methods: time series models and regression models. The advantage of these approaches is that they offer a lot of “bang for your buck”. On one hand, they are robust methods that can detect and extrapolate on patterns in your data like seasonality, sales cycles, trends, responses to promotions, and so on. On the other hand, they are easily accessible approaches, especially with the right tools.

Time Series Methods

Time series methods are forecasting techniques that base the forecast solely on the demand history of the item you are forecasting. They work by capturing patterns in the historical data and extrapolating those patterns into the future. Time series methods are appropriate when you can assume a reasonable amount of continuity between the past and the future. They are best suited to shorter-term forecasting (for example, projecting out 18 months or less). This is due to their assumption that future patterns and trends will resemble current patterns and trends. This is a reasonable assumption in the short term but becomes more tenuous the further out you forecast.

Common Time Series Models

Building Time Series Models

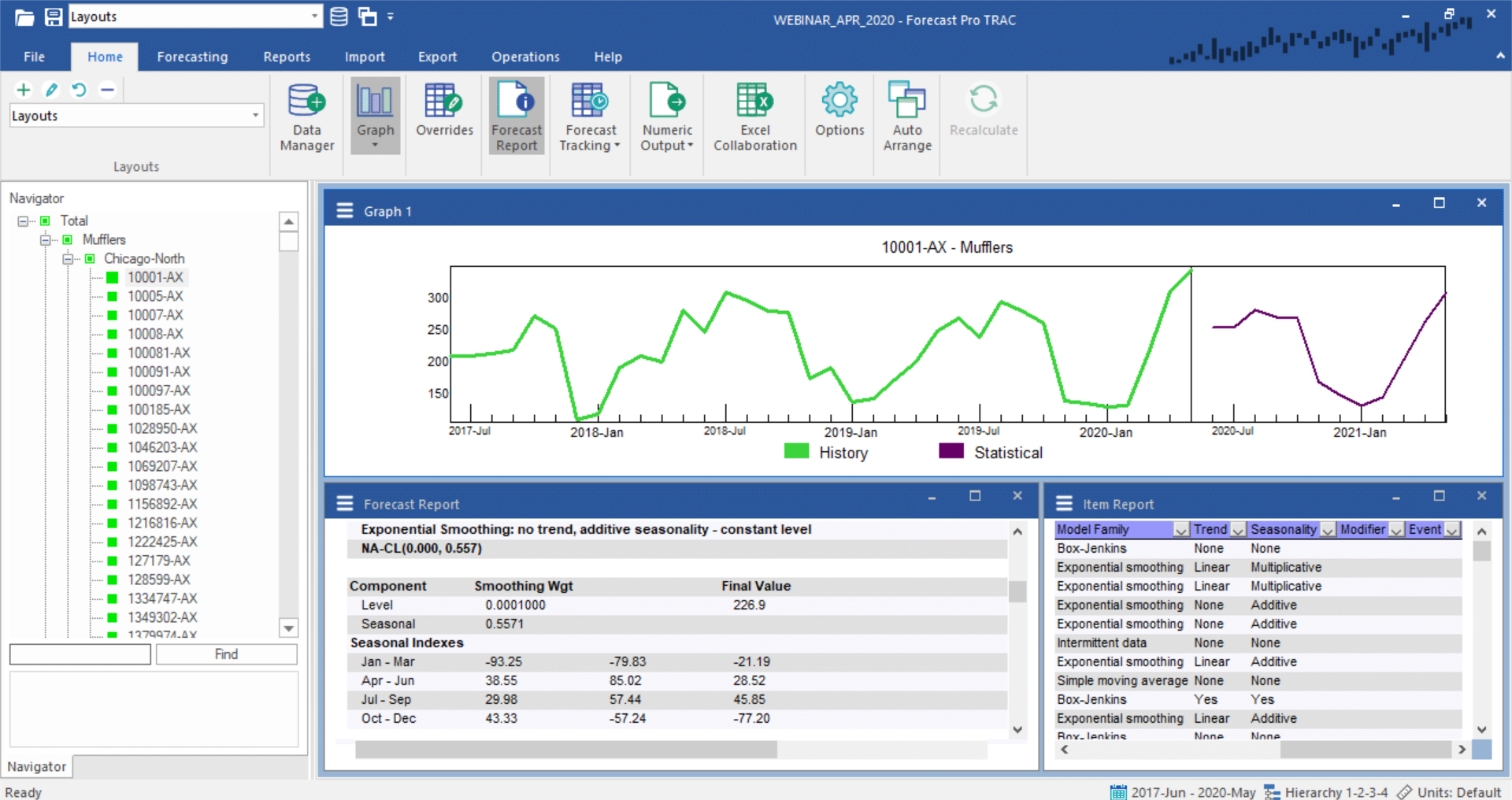

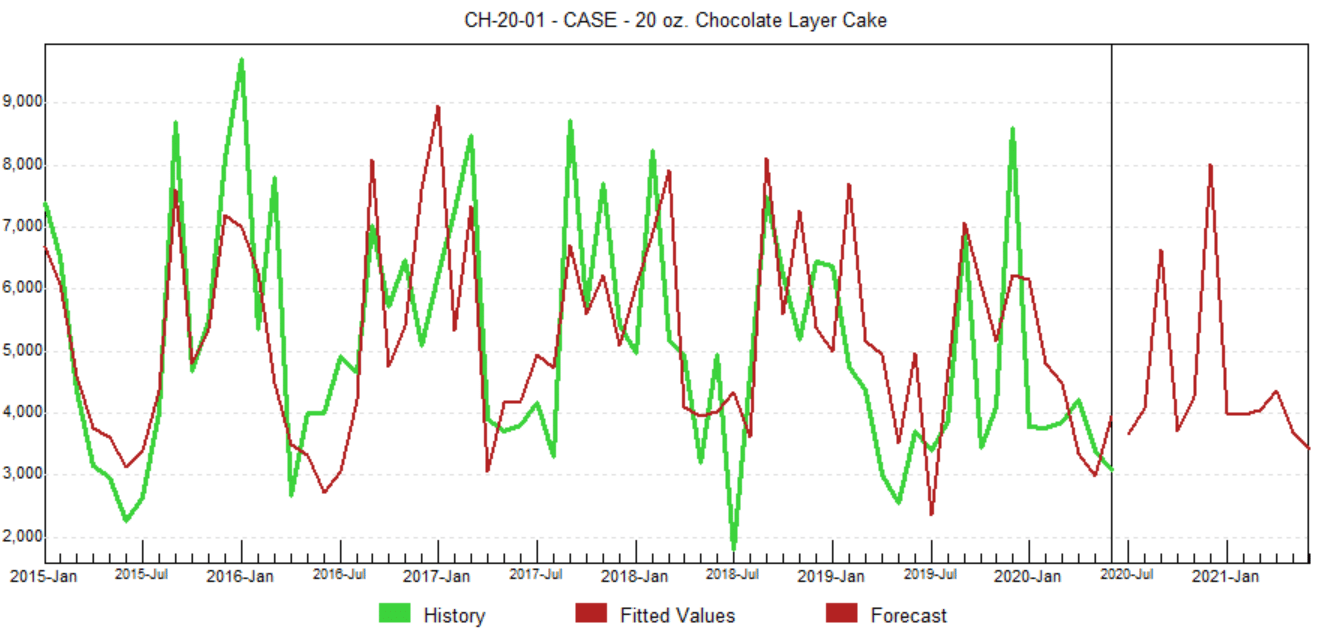

While many of these models can be built in spreadsheets, the fact that they are based on historical data makes them easily automated. Software packages can build large amounts of these models automatically across large data sets. In particular, data can vary widely, and the implementation of these models varies as well, so automated statistical software can assist in determining the best fit on a case by case basis.

Regression Models

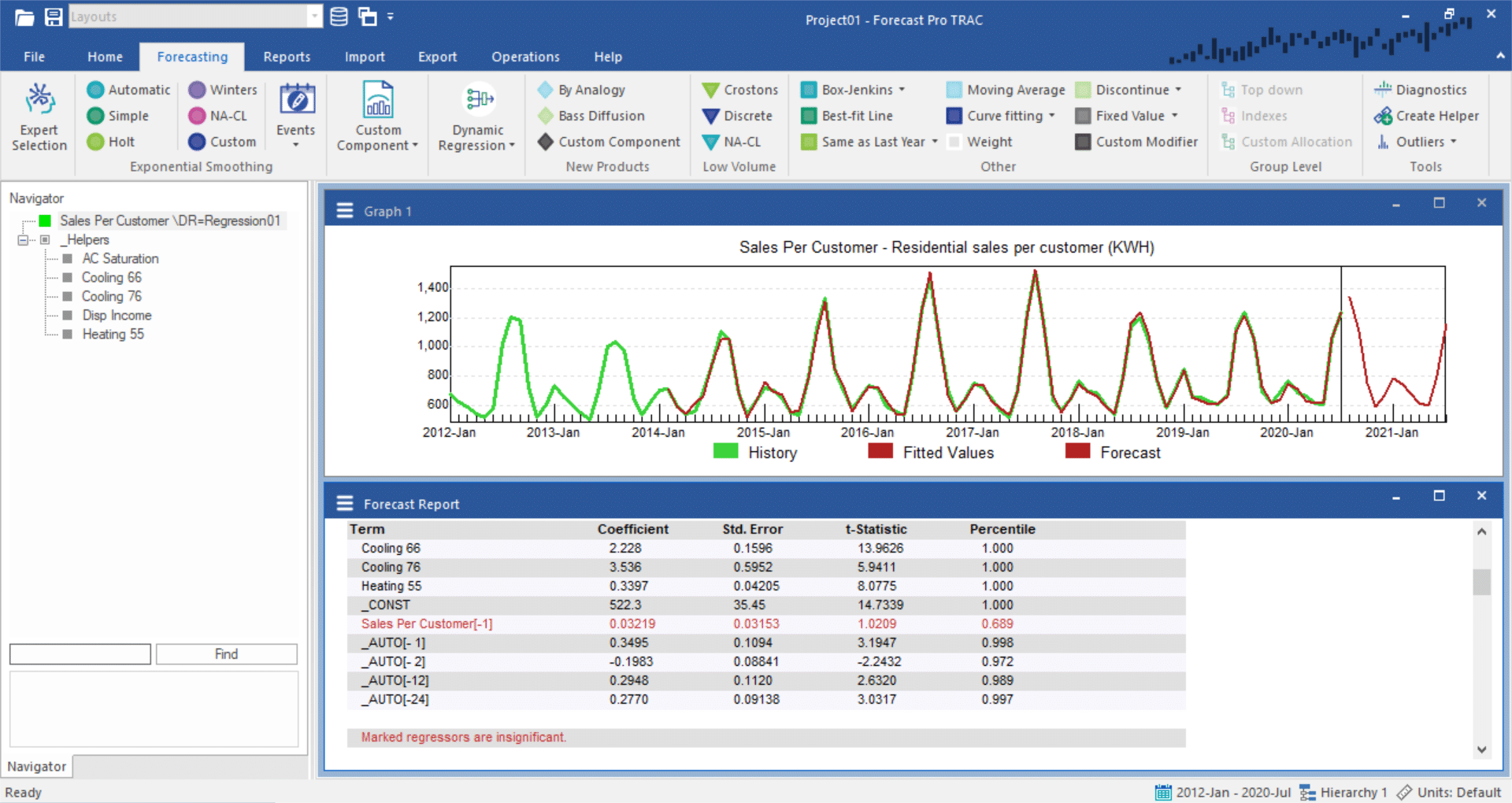

Dynamic regression models allow you to incorporate causal factors such as prices, promotions and economic indicators into your forecasts. The models combine standard OLS (“Ordinary Least Squares”) regression (as offered in Excel) with the ability to use dynamic terms to capture trend, seasonality and time-phased relationships between variables. The result is a model that will forecast more accurately than straight time series approaches when explanatory variables are driving the demand for your products or services and certain other conditions are met.

A well-specified dynamic regression model lends considerable insight into relationships between variables and allows for “what if” scenarios. For instance, let’s say that your dynamic regression model includes price as an explanatory variable. By quantifying the relationship between sales and price, the model allows you to create forecasts under varying price scenarios. “What if we raise the price?” “What if we lower it?” Generating these alternative forecasts can help you to determine an effective pricing strategy.

The “what if” analysis described above hints at the biggest drawback to using dynamic regression. A well-specified dynamic regression model captures the relationship between the dependent variable (the one you wish to forecast) and one or more independent variables. In order to generate a forecast, you must supply forecasts for your independent variables. If these independent variables are under your control (e.g., prices, promotions, etc.) or if they are leading indicators, this may not be a big issue. If, however, your independent variables are not under your control (e.g., weather, interest rates, price of materials, competitive offerings, etc.) then you need to keep in mind that poor forecasts for the independent variables will lead to poor forecasts for the dependent variable.

Building a Regression Model

While there are software tools out there that can automate time series forecasting very effectively, regression is usually a bit different. It is a method where knowledge of the technique and experience building the models is quite useful. Building a dynamic regression model is generally an iterative procedure, whereby you begin with an initial model and experiment with adding or removing independent variables and dynamic terms until you arrive upon an acceptable model. Tools like Forecast Pro provide a complete range of self-interpreting hypothesis tests and other diagnostics to help guide you through the process.

Conclusion

Statistical methods can provide a level of automation and accuracy that purely judgmental methods simply can’t provide on their own. Not only can these models help you identify recurring patterns and trends in your data, they can also save you tons of time and effort by automatically forecasting big data sets, and as a result you can direct your focus to where your judgment counts the most.

Forecast Pro

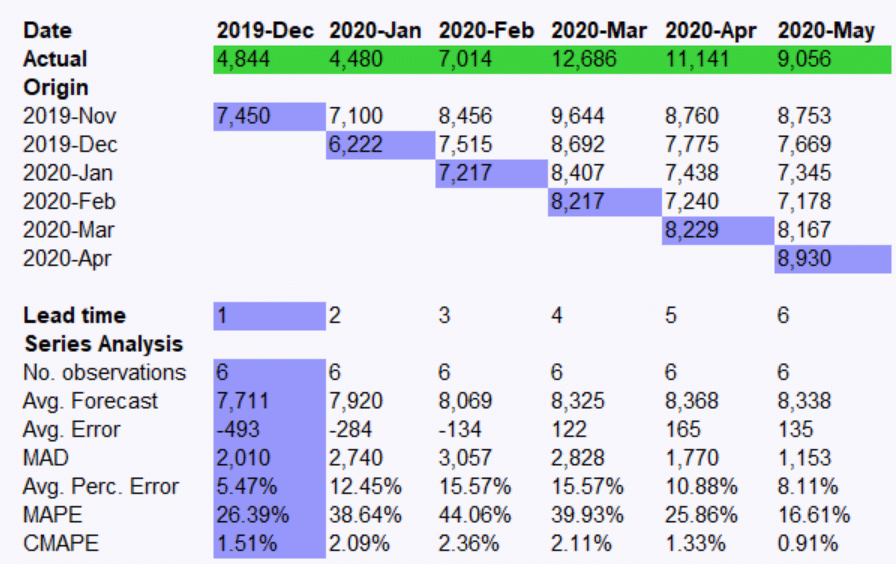

The screenshots above depict statistical sales forecasting using an off-the-shelf tool called Forecast Pro. Forecast Pro is a low-cost yet flexible demand forecasting package that implements both time series and regression forecasting methodology, among many other features. If you are interested in learning more, check out the quick tour, or contact us directly to try Forecast Pro out for yourself.

Additional Resources

Business Forecast Systems, Inc. delivers FREE educational webinars every quarter. We also archive every webinar we present—in particular, if you liked this article, you may be interested in:

The Ins and Outs of Exponential Smoothing

The Ins and Outs of Using Dynamic Regression Models for Forecasting

About Us

Founded in 1986, Business Forecast Systems, Inc. (BFS), is the maker of Forecast Pro, the leading software solution for business forecasting, and is a premier provider of forecasting education. With more than 40,000 users worldwide, Forecast Pro helps thousands of companies improve planning, cut inventory costs and decrease stockouts by improving the accuracy of their forecasts.